November 13, 2025

by Bob Coleman

Executive Director, NASLB

What SBA Loan Brokers Need to Know: One Point vs. Two Points in Lender Referral Fees

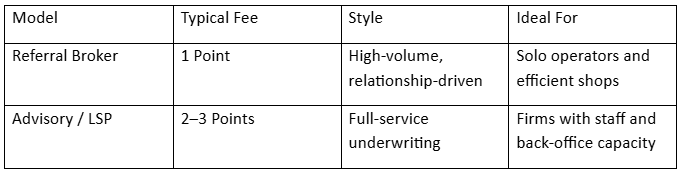

The SBA broker world has evolved — and with it, how lenders compensate the people who bring them solid, fundable deals. If you’ve been around this business long enough, you know the difference between a “referral” and a “ready-to-close” file can mean the difference between earning one point or two. Here’s how that breaks down.

The One-Point Model: The Referral Broker

This is the classic matchmaker model. You meet the borrower, gather a few tax returns, pull together a basic deal summary, and send it off to the SBA lender most likely to say yes. Your value is in knowing where to send it: who’s open to startups, who’s doing franchises, and who’s willing to do business acquisition loans in Florida.

It’s all about speed, relationships, and volume. The best brokers in this lane operate lean. They’ve built a stable of reliable BDOs who know how to close. They stay in constant communication, know every lender’s credit box, and get rewarded for efficiency.

Typical fee: One point on the gross loan amount. Nothing wrong with that. For many, it’s a six-figure business with low overhead and fast turnaround.

The Two-Point Model: The Advisory or LSP Broker

Then there’s the other model — the advisory model — and it typically earns double. This is where brokers step up and act like an outsourced SBA department. These brokers don’t just refer deals; they underwrite them.

They verify eligibility, check background and credit, run cash flow, validate the source of injection, and package the file exactly the way a bank would. Many use systems like Ventures Lending Technologies, and they employ dedicated processors, underwriters, and closers.

By the time that loan hits a lender’s desk, it’s not a lead — it’s a ready-to-fund package. That’s why lenders are willing to pay two points (and sometimes more). The file is clean, the work is done, and the lender can move fast.

Why Lenders Are Paying Up

SBA lenders today make real money on the secondary market. On a $1 million loan with a 75 percent guarantee, they can sell that guaranteed portion and book a 10 to 15 percent premium immediately. That’s $75,000 to $100,000 in gain on sale — before interest income. So if a broker brings them a well-documented, compliant, fundable deal, paying one or two points is a small price to pay for that kind of yield.

When to Choose Which Model

The takeaway: the more of the lender’s work you do, the more you can earn. Both models are valid and profitable. The choice is whether you want to focus on volume or depth. And in today’s market — with SBA lenders chasing quality originations and brokers under more scrutiny than ever — quality pays.